9/7/2024

Meme Coin Pump and Dumps, Unmasking the Hype and Safeguarding Your Digital Wealth.

The meme coin craze has swept the crypto market in 2024, even eclipsing Bitcoin's new all-time highs and Ethereum's significant upgrades. The total market capitalization of meme coins reached a staggering $60 billion in April, with Solana-based meme coins leading the charge, averaging over 8,000% year-to-date returns, far surpassing Ethereum's 962%. New tokens like WIF and BOME surged by over 1,000% shortly after their launch in the first half of this year.

However, beneath this seemingly booming surface, the meme coin market harbors hidden risks, with the most concerning being "pump and dump" schemes. In April alone, 12 Solana-based meme coin projects vanished after raising $26.7 million in presale funds, leaving countless investors with nothing.

Pump and dump scams have cost countless traders dearly. How do these schemes work, and how can we identify and avoid them to protect our investments from losses?

Pump and Dump: A Carefully Orchestrated Scam

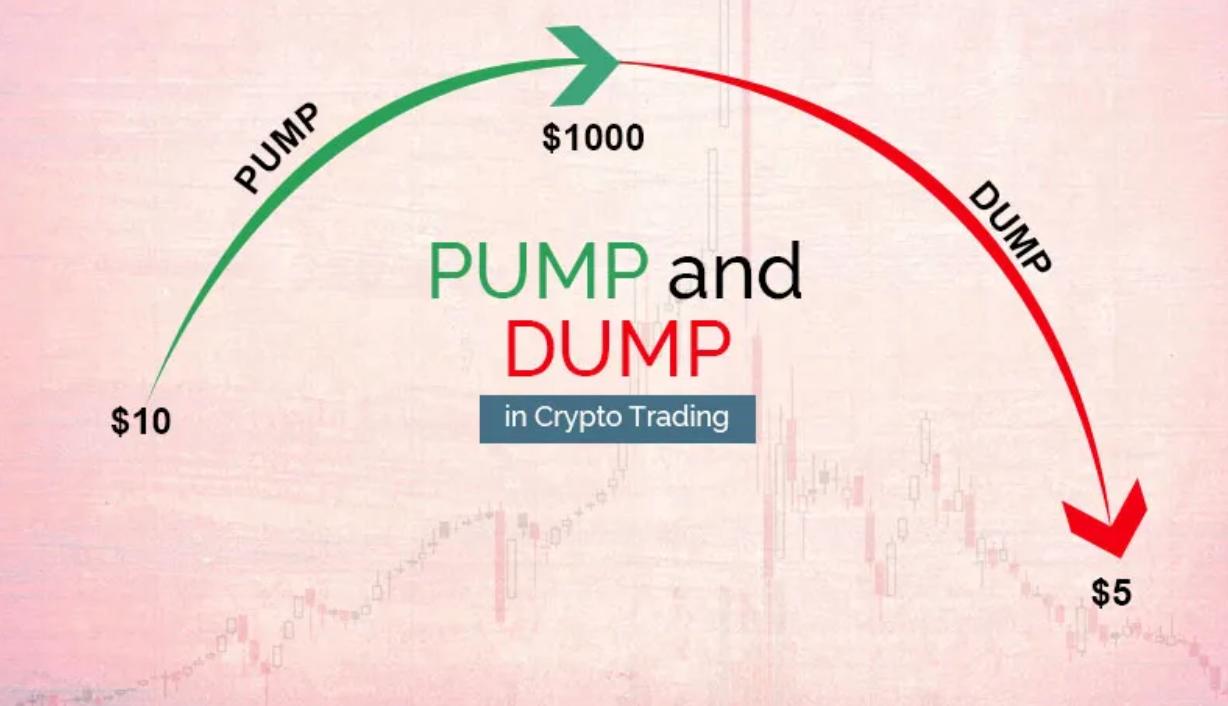

"Pump and dump" is a prevalent scam in the cryptocurrency market, often targeting meme coins with low market capitalization. It involves a series of carefully orchestrated steps to manipulate prices, ultimately maximizing the profits of the manipulators.

The Pump and Dump Process

- Accumulation: A small group of individuals or a single entity secretly accumulates a large amount of a low-cap meme coin, setting the stage for their scheme. This process is often called "building a position."

- Hype Creation: They use social media, forums, and other online platforms to spread exaggerated claims and misleading information about the coin, generating "positive news" to attract more investors. This includes fabricating false partnerships, exaggerating the project's technical advantages, and even hiring influencers or celebrities for endorsements. This strategy is known as "pumping."

- Price Surge: Due to the hype and FOMO (fear of missing out), some investors believe in the coin's value and begin buying, pushing the price up. The manipulators continue to promote the coin to maintain market momentum, drawing more people into the "frenzy."

- The Dump: When the price reaches its peak, the manipulators sell off their massive holdings. This sudden influx of supply creates a market imbalance, causing the price to crash dramatically. This is known as "dumping."

- The Aftermath: Investors who bought at the peak find their coins significantly devalued or even worthless. The manipulators walk away with substantial profits while leaving other investors with substantial losses.

How to Identify Pump and Dump Schemes

Pump Fun's Unique Context

Pump Fun, a Solana-based platform for launching meme coins, provides users with a quick and convenient way to create their own meme coins. However, this ease of access has also made Pump Fun a breeding ground for pump and dump schemes. While Pump Fun has implemented measures to discourage scams, such as not holding investor funds, it cannot completely eliminate the risks. Therefore, you must exercise extreme caution when using the Pump Fun platform.

Recognizing the Signs of a Pump and Dump Scheme

- Sudden and Unexplained Price Spikes: When a meme coin's price skyrockets without any significant news or project development, be cautious. This could be a sign of manipulation by pump and dump orchestrators. Excessively high and rapid price increases are often a signal of market manipulation.

- Excessive Hype: If a project is overly promoted on social media, with exaggerated reviews and fake endorsements, be wary. Be especially cautious of projects that promise high returns, emphasize price increases without discussing actual applications or technical advancements.

- Lack of Transparency: If you lack information about a project's team, roadmap, or development progress, proceed cautiously. Anonymous teams, vague goals, or an emphasis on price increases without explaining the actual use case and technology are red flags that should raise concerns.

- High Trading Volume with Low Market Cap: When a low-market cap meme coin experiences an unusual surge in trading volume, be on high alert. This could be a clear indication of a pump and dump scheme. Low-market cap coins are easier to manipulate as the manipulators only need to invest a small amount to influence the price.

- Community Activity: Pay attention to the project's community, observing its activity and the genuine interest of its members. If a project relies solely on "shilling" and "vote-buying" to attract attention, with no real community building or technological development, it may be a concern.

- Watch Out for Low Liquidity: Low liquidity meme coins are easier to manipulate, so be cautious. High liquidity often indicates a larger number of investors participating in the market, suggesting greater price stability.

Choosing a Secure Wallet

If you are primarily focused on meme coin trading and using the Pump Fun platform, it's crucial to choose a wallet that supports fast transactions and DeFi integration. Consider options like OKX, Phantom, or Solflare:

- OKX Wallet: A multi-platform (OKX App/Web/Extension) universal crypto wallet that supports over 3000+ cryptocurrencies, 80+ networks, tens of thousands of decentralized applications, and the Web3 ecosystem.

- Phantom: Known for its user-friendly browser extension wallet, which integrates seamlessly with the Pump Fun platform.

- Solflare: Another browser extension wallet, offering more features for interacting with Solana applications, while also catering to fast transaction needs.

Pump Fun Coin Trading Bot

If you have extremely high-speed requirements for trading, consider using the Pump Fun Coin trading bot (link: https://pumpfuncoin.io/pump-bot).

Protecting Your Investments

Before investing in any meme coin, keep the following in mind:

- Conduct Independent Research: Thoroughly research the project behind the coin, including its team, roadmap, development plan, and real-world use cases. Verify project information and pay attention to its transparency.

- Invest Wisely: Don't invest all your funds in a single meme coin. Diversify your investments to mitigate risk and only invest what you can afford to lose. Don't be swayed by promises of high returns without critically evaluating the project.

- Monitor Project Progress: Pay attention to the actual development of the project, not just price fluctuations. A truly valuable project will continue to develop and have a clear roadmap.

- Stay Rational: Don't get caught up in social media hype and propaganda; maintain a clear head and think critically. Be wary of projects that over-promote, lack real value, and lack transparency.

Conclusion

Pump and dump schemes are prevalent in the meme coin space. These schemes use deceptive tactics and manipulated hype to harm investors. By conducting thorough research, thinking critically, and investing prudently, you can better identify these scams and protect your digital assets. Remember, in the world of cryptocurrency, where opportunities and risks intertwine, staying informed, thinking rationally, and investing wisely are paramount!

Frequently Asked Questions

-

Is it possible to profit from pump and dump schemes? Yes, it is possible to profit from pump and dump schemes, but it is highly unethical and illegal in regulated markets. Those who orchestrate these schemes can make significant gains by artificially inflating the price of a cryptocurrency and then selling off their holdings at the peak. However, this practice is deceptive and harms other investors who buy in at inflated prices and suffer losses when the price crashes. Additionally, participating in such schemes can lead to severe legal consequences and reputational damage.

-

What is a pump and dump in crypto? A pump and dump in crypto is a type of market manipulation where the price of a cryptocurrency is artificially inflated through coordinated buying and aggressive promotion. The orchestrators of the scheme spread positive hype about the coin to attract unsuspecting investors. Once the price reaches a peak, they sell off their holdings (the "dump"), causing the price to plummet and resulting in significant losses for those who bought at higher prices. This practice is common in the cryptocurrency market due to the lack of regulation and the ease of spreading misinformation via social media.

-

How to avoid becoming a victim of a pump and dump scheme:

- Conduct independent research: Thoroughly understand the project's team, roadmap, technology, and community. Don't focus solely on price fluctuations.

- Focus on the project's actual value: Don't be swayed by short-term hype; look for the project's underlying value and development potential.

- Invest wisely: Don't invest all your funds in one meme coin. Diversify your investments and only invest an amount you can afford to lose.

- Stay alert: Be cautious of social media hype and propaganda; don't let "FOMO" cloud your judgment.

Remember, in the cryptocurrency market, staying cautious, investing rationally, and maintaining critical thinking are essential for finding balance between risk and opportunity!

Further Reading

- How to Use Pump Fun?

- Top Pump Fun Coin - Discover the Latest Meme Coin Trends

- Pump Fun Bot/API - Your Meme Coin Trading Weapon

- Best Solana Wallets for 2024 - Securely Manage Your SOL and Meme Coins

- How to make a Meme Coin on Pump Fun - Embark on Your Meme Coin Journey

- About Pump Fun Coin, Your Pump.fun Expert Guide

- Pump Fun Coin Frequently Asked Questions (FAQ)